Maybe you know how much you owe. Maybe you don’t. Maybe you got an email about a loan exit interview. Maybe you opened it.

After all, you did agree to this. You did sign those stupid pieces of paper.

It’s not like you’re avoiding talking about your student debt. Maybe you even Googled debt consolidation once. Maybe you meant to Google it once.

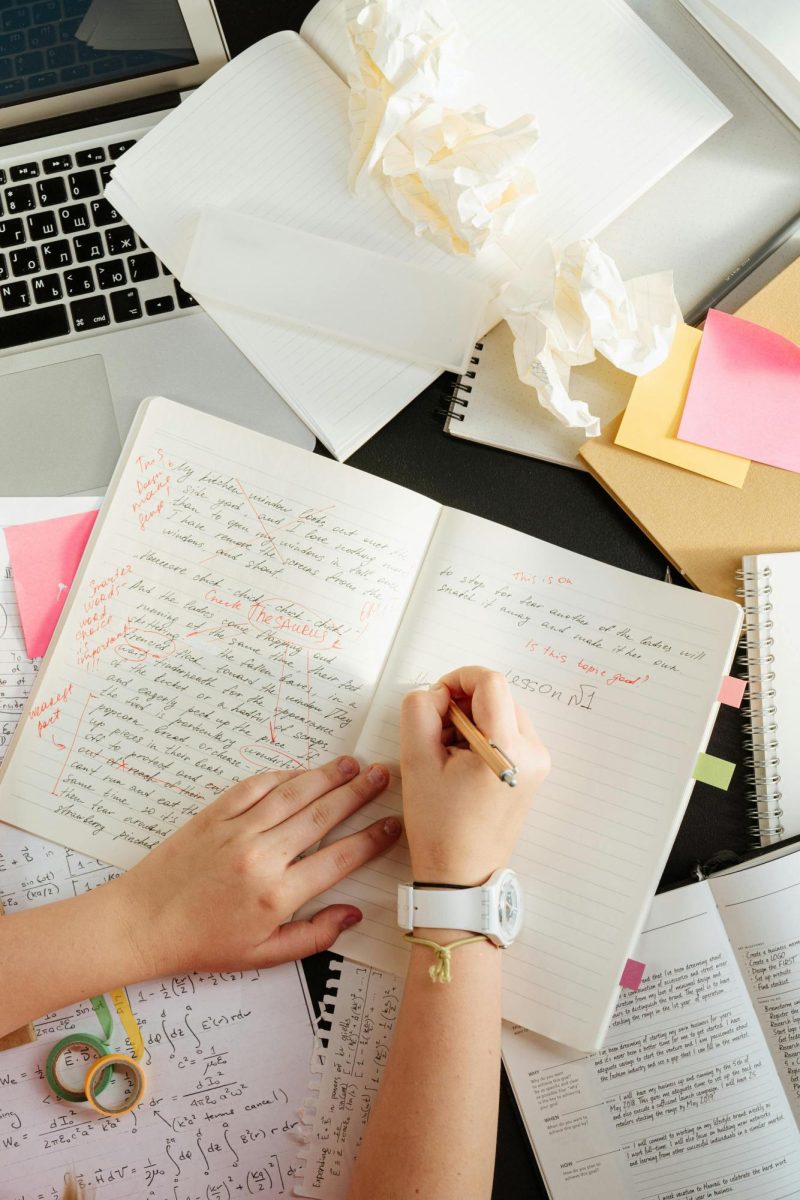

And you’ve got three 10-page papers to write anyway. You can’t worry about your debt. Not now. You’ve got a couple more weeks.

Student debt almost tripled between 2004 and 2012, according to a study by The Federal Reserve Bank of New York, and the average graduate’s debt has leaped to $27,000.

The media is calling this a student debt crisis. For students, particularly those about to graduate, this is a very personal crisis. It’s a chain binding the recently released graduate, adding more stress to the already stressful entry into the job market.

$27,000 is a lot of money, particularly for a 22-year-old. It’s really almost an unimaginable amount of money. But for many students, including myself, it is also a very real amount.

While there is certainly value in looking at this student debt crisis on a large scale, for those of us actually dealing with debt, it can only be seen from a smaller, more personal level. Otherwise, it would simply be overwhelming. But, what can we as students do to towards dealing with our debt?

“Pay it off as soon as possible, and don’t get any more,” said Maia Dery, instructor of art and experiential learning. “I find it alarming that students make such a massive decision without looking forward.”

Looking forward is key. College was a good investment, particularly if you went to the right college for the right reasons. Investing in a college education was like investing in a car or a house. Pace yourself as you pay it off and be aware of what you’re doing.

“I think that Guilford is a bargain for any student that shows up with intention, integrity and energy,” said Dery. “It’s amazing how many students come to college without that. It’s hard to fault people for failing to imagine how powerful a liberal arts education be when they come from a secondary education system that discourages imagination.”

Maybe it’s best to at least get a start paying off your debt before taking on more for graduate school. Be purposeful about how you use loans. Sure, it would have been easier if you were doing this all along, but now is as good a time as any. The longer you put it off, the harder it’s going to hit.