Twenty-six religious institutions, 22 cities, two counties, 11 colleges and universities, 19 foundations and several other institutions have committed in some form to divest from fossil fuels.

Characterized as “the fastest growing divestment movement in history” by an Oxford University study, the Fossil Fuel Divestment campaign is calling upon institutional leaders to divest themselves of any funds that include fossil fuel public equities and corporate bonds.

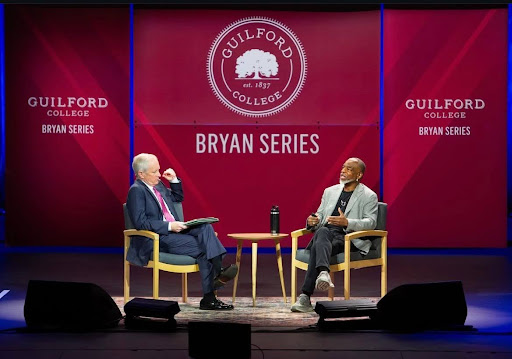

The opposite of investment, divestment is the act of getting rid of unethical stocks, bonds and other investment funds. “Divestment is a movement that aims to draw publicity and attention to specific practices,” said Gurney Professor of English at Harvard University James Engell in an email interview with The Guilfordian.

“It is less about creating immediate financial pain for fossil fuel corporations and more about aligning institutions’ investments with their values,” said Jenny Marineau, U.S. field manager for 350.org, and Jay Carmona, national divestment campaign manager for 350.org, in an email interview with The Guilfordian.

350.org is a global climate change movement and website launched by Bill McKibben and is responsible for the Fossil Fuel Divestment campaign.

Past successful divestment campaigns have helped end apartheid in South Africa and changed social attitudes towards tobacco.

A major focus of all of these divestment campaigns: College campuses.

To many, it is paradoxical that universities around the nation have endowments invested in and so heavily reliant on fossil fuel industries, often the same universities that claim to be pioneers in clean energy development and sustainability. As noted by the Fossil Free campaign, “it makes no sense for colleges to green their campuses but not their portfolios.”

Students across the nation are rallying around this cause. With an endowment of over $30 billion, a major target of this campaign is Harvard.

In a statement released by President of Harvard Drew Faust, the college’s anti-divestment stance was evident. “While I share their belief in the importance of addressing climate change, I do not believe that university divestment from the fossil fuel industry is warranted or wise.”

Faust went on to present a number of arguments against divesting, including the financial risk and not wanting to use the university’s endowment as an instrument for political change.

“Harvard is a large, complex institution, and people in it have a variety of views,” said Engell. “It will take education, information and persistence to change the investment policies currently in place.”

Chuck Collins, senior scholar at the Institute for Policy Studies and co-founder of Wealth for the Common Good agreed.

“Changing the status quo, especially around investment policies, always encounters resistance,” said Collins. “It’s an inherently conservative arena.”

Other colleges and universities around the nation are facing a similar battle — balancing financial needs with their social and ethical responsibilities.

“Making any sort of change is going to take a very intentional, long-term plan,” said junior Julia Draper. “If done intentionally, we can reduce the financial risk of investing ethically.”

Along with senior Tom Clement and sophomores Lily Collins and Marek Wojtala. Draper examined Guilford College’s endowment portfolio and is currently working to promote greener investments.

As the students realized, taking a position on divestment is often complicated by the distribution of a college’s investments.

“About $7 million of Guilford’s endowment is invested in fossil fuels,” said Draper. “But those fossil fuel companies are grouped into index funds with other companies, which make divesting complicated.”

However, as demonstrated by the Fossil Fuel Divestment campaign’s most recent victory — convincing Pitzer College to divest its $124 million endowment — the movement is growing.

More institutions are finding creative ways to divest and maximize returns.

To many, the question now is not whether the campaign will survive, but rather, who will join next?